Supporting independent retailers is a big part of why we do what we do here at Creoate.

And how lovely it would be if we could grab a cup of tea with every small retail business and hear all about life right now, in a post-lockdown, post-pandemic world.

What are you struggling with? What’s your focus going forward? And — the simple question without a simple answer — how’s business?

But with some 553,000 retail businesses in the UK, this could take a while. So instead, we surveyed over 550 independent UK retailers to get an insight into small business life right now. Here’s what we found.

On this page

- First, who exactly are we talking to?

- How independent retailers are selling

- How the wider environment is impacting them

- How has WFH affected footfall?

- Is the impact of the pandemic still being felt?

- How much of an issue is Brexit?

- Sustainability is a major focus

First, who exactly are we talking to?

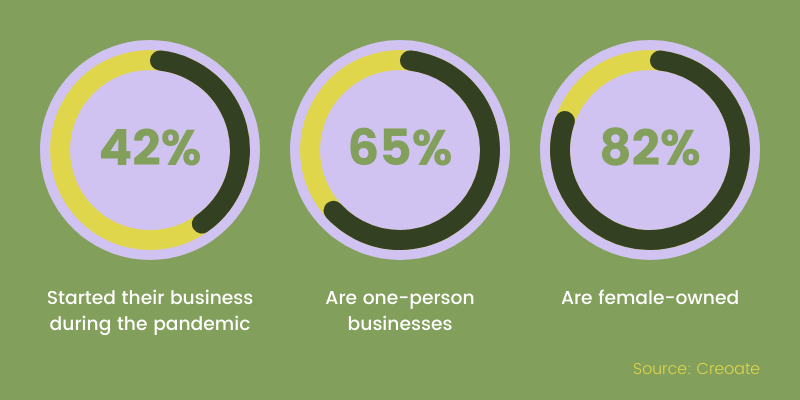

Quick look:

- 42% of respondents had been in business for less than a year

- Nearly two thirds (65%) are one-person businesses

- 82% are female-owned

While the pandemic and repeated UK lockdowns put a real strain on many businesses (something we’ll cover more in a later section), it was also a surprisingly entrepreneurial time — in fact, a record number of startups were launched in the UK in 2020.

We collected responses to this survey in September 2021, and a massive 42% of respondents had only been in business for less than a year at this point. That’s versus 37% who had been in business for one to five years, and 21% who had been around for longer.

It’s hard to pin down exactly why the pandemic seems to have led to this surge in entrepreneurialism. Extra time, opportunity to focus, and a shift in perspective all seem to have played a part (not to mention, in the case of brave new brick and mortar retailers, the opportunity to jump on some bargain lease agreements).

How independent retailers are selling

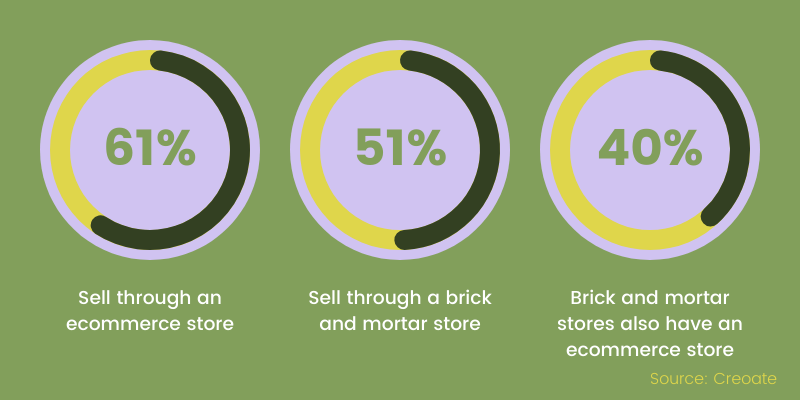

Quick look:

- 61% of retailers sell through an ecommerce store

- 51% of retailers have a brick and mortar store

- But only 40% of retailers with a brick and mortar store also have an ecommerce store

So how exactly are small retail businesses selling? When asked respondents to select all the ways they sell, 61% of retailers said they have an ecommerce store (the most popular choice). 51% have a physical brick and mortar store, and 3% sell via subscription boxes.

Subscription boxes were already trending upwards before the pandemic, but this definitely seems to have accelerated the trend. The London Review of Books, for example, has a specialist bookshop located in central London, and had to pivot quickly when lockdown hit in March last year. They launched a subscription box service which combined an unusual read with an extra gift. The boxes have proved hugely successful, and are still going now, even though the bookshop has long since reopened.

Interestingly, of those who do have brick and mortar stores, only 40% also have an ecommerce store. 1% sell via subscription boxes, and just 3% sell via ‘other’ means. This shows that, despite many businesses adapting to sell via non-physical channels during the pandemic, a huge percentage are still very reliant on their store to do business.

How the wider environment is impacting them

Quick look:

- 41% brick and mortar stores claim working from home has led to reduced footfall

- 38% brick and mortar stores are still feeling the negative impact of the pandemic

- Brexit and the pandemic are both presenting a near-equal challenge to businesses

- 37% of businesses describe themselves as ‘somewhat concerned’ by the plans to raise NI contributions in 2022

How has WFH affected footfall?

When asked about the impact of new working from home/hybrid working patterns on footfall, 41% of businesses with a physical presence said the shift towards working from home had negatively impacted them. 35% said they hadn’t been impacted, and 14% felt they had more footfall now.

‘Originally starting the pandemic as a gallery, we restructured our business to become a concept store selling homeware, coffee and gifts’, explained Lauren of mlkwood store, Bridlington. ‘The change in footfall has been hard for a small independent business. We have had to adapt by focusing on online sales and advertising safe click and collect, and local delivery. Living in a small coastal town, footfall significantly decreased during the pandemic. But thankfully, due to many people taking “staycations” this summer, we are starting to see this increase. Fingers crossed for a safe and busy Christmas.’

Interestingly, 10% also estimated that they receive the same footfall, but at different times.

‘We noticed that our customers’ visiting hours have changed significantly over the last 18 months’, Selin of Richmond-based florist Create & Wild told us. ‘Customers have been visiting more often during the day rather than in the evenings, and this has actually helped us decide that our pre-lockdown opening hours no longer serve us and our clients well. We previously had a huge commenter rush at the end of the day, and this sadly no longer really exists. We have begun to close earlier rather than staying until 8pm which was our previous closing time. Takings have decreased overall, but in some ways, as a small independent business with just a couple members of staff, I have been able to actually create a more sustainable way of working. I get home at a more reasonable time and am able to enjoy more time at home with my husband, and do some more things rather than just being at work!’

Is the impact of the pandemic still being felt?

Of those retailers who had experience of running their business before Covid-19, 48% said they are still feeling the negative impact of the pandemic, although 34% also said their business is going stronger now than it was before Covid-19.

For retailers with an ecommerce store, there was less disparity here; 44% said they’re still feeling the negative effect of the pandemic, but 41% felt they’re in a stronger position now.

How much of an issue is Brexit?

When asked which presented a bigger challenge to their small retail business — Brexit, the pandemic, or ‘other’ — Brexit came out narrowly on top; 42% of businesses cited Brexit as their ‘biggest current challenge’, versus 41% choosing Covid-19.

For the 17% who selected ‘other’ as their biggest challenge, we asked them to expand on their choice. While some were facing very specific challenges — including ‘IOS 14’ and ‘supermarkets moving into the vegan market’, responses generally fell quite evenly into four camps:

- Lack of time (‘not enough hours in the day’)

- Cashflow/finance difficulties

- Marketing challenges

- Stock-related logistical challenges

While Brexit only narrowly presented the biggest challenge overall, among ecommerce stores this was more pronounced; 46% of ecommerce store owners say Brexit is their biggest challenge, versus 35% choosing the pandemic, and 20% selecting ‘other’.

But despite all this, Brexit-related staff shortages didn’t seem to be causing as much havoc within the retail sector as you might expect. Of those with more than one employee, only 16% claimed to be suffering with staff shortages currently. Of this 16%, around half (49%) put this down to struggling to recruit staff, and only 27% identified this as a Brexit-related issue (although, of course, Brexit may play a part in the struggle to recruit new people).

Are NI contribution increases a concern?

The UK Government has announced plans to raise National Insurance by 1.25% in April 2022. When we asked retailers how concerned they were about the impact this would have on their business, the most popular response was ‘somewhat concerned’ (37%). 29% are ‘not really concerned’, and only 13% claimed to be ‘very concerned’. 7% are ‘not concerned at all’, and in fact ‘think it’s the right thing to do’.

Is the impact of the pandemic still being felt?

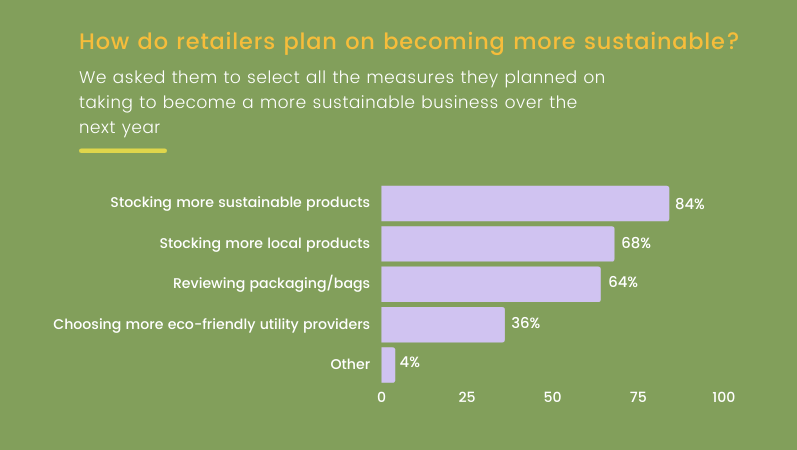

Quick look:

- 93% of retail businesses described sustainability as a focus for the next 12 months

- 59% of these described sustainability as ‘a big focus’

- The most popular method of achieving this was to stock ‘more eco-friendly/sustainable products’, second to ‘stocking more local products’

We know from speaking with retailers that sustainability is a key decision factor when looking to take on new stock. But with so many other pressing challenges facing retailers today, we were blown away by the fact that 93% of retailers said sustainability is a focus for the next 12 months, and even more so by the fact that 59% of these retailers called it a ‘big focus’.

When we asked how retailers are making their business more sustainable, the most popular response was by ‘choosing products which are more sustainable/eco-friendly’ (84%), followed by ‘stocking more local products’ (68%), and ‘reviewing [their] own packaging/bags’ (64%).

Aside from the four sustainability measures we put forward, the retailers who selected ‘other’ (4%) had some interesting suggestions for what they’re doing to make their business more sustainable; from considering how they travel to work, to planting a tree for every purchase.

Whatever form it takes, it’s clear that a small business-heavy economy is a positive thing for our planet. When asked why sustainability was a focus for these businesses, the answers were touching, and often conveyed a huge amount of passion and commitment, with sustainability at the very heart of their mission, rather than a tacked-on afterthought:

- ‘Sustainability is at the core of my business. We are the only children’s store in the UK to be Planet Mark certified, meaning we report our carbon data year on year with a commitment to reduce our impact.’

- ‘It’s the most important thing to me and my business.’

- ‘Making sustainably-made products more accessible is why I started my store.’

However, some responses also highlighted the challenges of balancing price point and sustainability, with geographical/socioeconomic context being a key point of consideration; while one brick and mortar retailer claimed sustainability was a focus because ‘people have money around here!’, it wasn’t a focus for another because ‘customers are only prepared to pay so much’.

Final thoughts

We learnt so much from carrying out this survey, and we want to thank every wonderful retailer who gave up their time to take part — we know it’s in short supply for a lot of you, which makes us all the more grateful!

There’s a lot to unpack here, and it’s clear that we’re not ‘out of the woods’ yet when it comes to either Brexit, or the Covid-19 pandemic. But we have a renewed sense of pride at being part of such an entrepreneurial and sustainability-focused community of retailers. We’ll continue to advocate for and champion you in any way we can.

We’d love for you to reference our original research and use the infographics included in this post. Hell, shout it from the rooftops! Just please be sure to credit Creoate with a link back to this page when you do. You can download high res versions of the infographics here.

Not registered with CREOATE yet? Sign up now and start shopping wholesale with us today.

Related articles:

Browse Popular Categories at CREOATE: Wholesale Jewellery | Wholesale Gifts | Wholesale Stationery | Wholesale Beauty Products | Wholesale Mugs | Wholesale Homeware | Wholesale Pet Supplies | Wholesale Gourmet Food | Wholesale Garden & Outdoor | Wholesale Baby & Kids Products

Browse Trending Collections on CREOATE: Wholesale Halloween | Wholesale Mother's Day Gifts | Wholesale Father's Day Gifts | Wholesale Valentine's Day Gifts | Wholesale Spiritual Supplies

>> View all